Introduction: Wondering What You’ll Walk Away With After Divorce?

When going through a divorce, one of the biggest questions is: What am I going to keep? You have worked hard to build a life—your home, your savings, your retirement accounts—and the thought of splitting it all up can be both confusing and overwhelming.

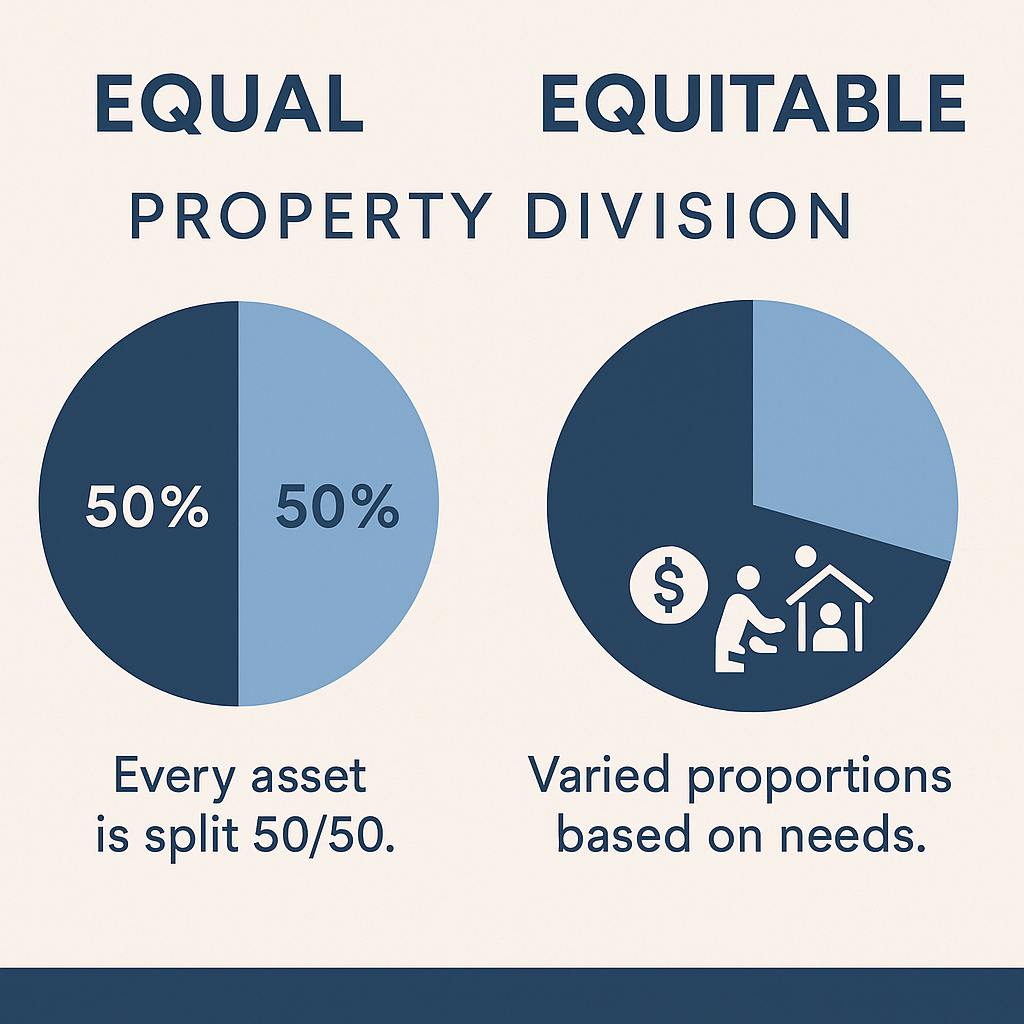

The truth is, dividing property in divorce, especially in New Jersey, is rarely as simple as a 50/50 split. It is about fairness—not necessarily equality. And that is where a conceptual asset division calculator becomes incredibly useful. While no online tool can predict your exact outcome, understanding how New Jersey courts handle asset division gives you the clarity—and confidence—you need to plan your future.

⚖️ Key Takeaways: NJ Asset Division

- Equitable, Not Equal: New Jersey divides marital property fairly, considering many factors beyond a 50/50 split.

- Identify Property: Clearly separate marital assets/debts (acquired during marriage) from separate property (pre-marital, inheritance).

- Inventory Everything: Make a comprehensive list of all assets and debts.

- Factors Matter: Court considers marriage length, financial contributions, caregiving roles, future needs, and more.

- Estimator, Not Predictor: Online calculators are conceptual tools; your unique case requires professional legal advice.

Confused? We can clarify your unique situation.

Understanding Equitable Distribution in New Jersey

What Does “Equitable” Really Mean?

New Jersey follows the legal principle of equitable distribution. That means the court seeks to divide marital property fairly, not necessarily equally. Fairness depends on many factors, including financial contributions, caregiving roles, and future needs.

🔍 Key Insight: If you earned less but supported your spouse’s career or stayed home with children, the court still considers that a meaningful contribution.

Equal” vs. “Equitable” distribution with real-world examples

Step 1: Identify Marital vs. Separate Property

Before you can calculate anything, you need to understand what is considered “up for grabs.”

What’s Marital Property?

- Assets acquired during the marriage (regardless of who earned them)

- Homes purchased together

- Retirement savings and 401(k) contributions made during marriage

- Joint bank and investment accounts

What is a Separate Property?

- Assets owned before the marriage

- Inheritances or personal gifts (kept separate)

- Some personal injury awards

💡 Pro Tip: If you deposited an inheritance into a joint account, it may be considered “commingled” and subject to division.

📄 Downloadable Tool: Marital vs Separate Property A Complete Guide

Download Marital V.S. Separate Property Guide

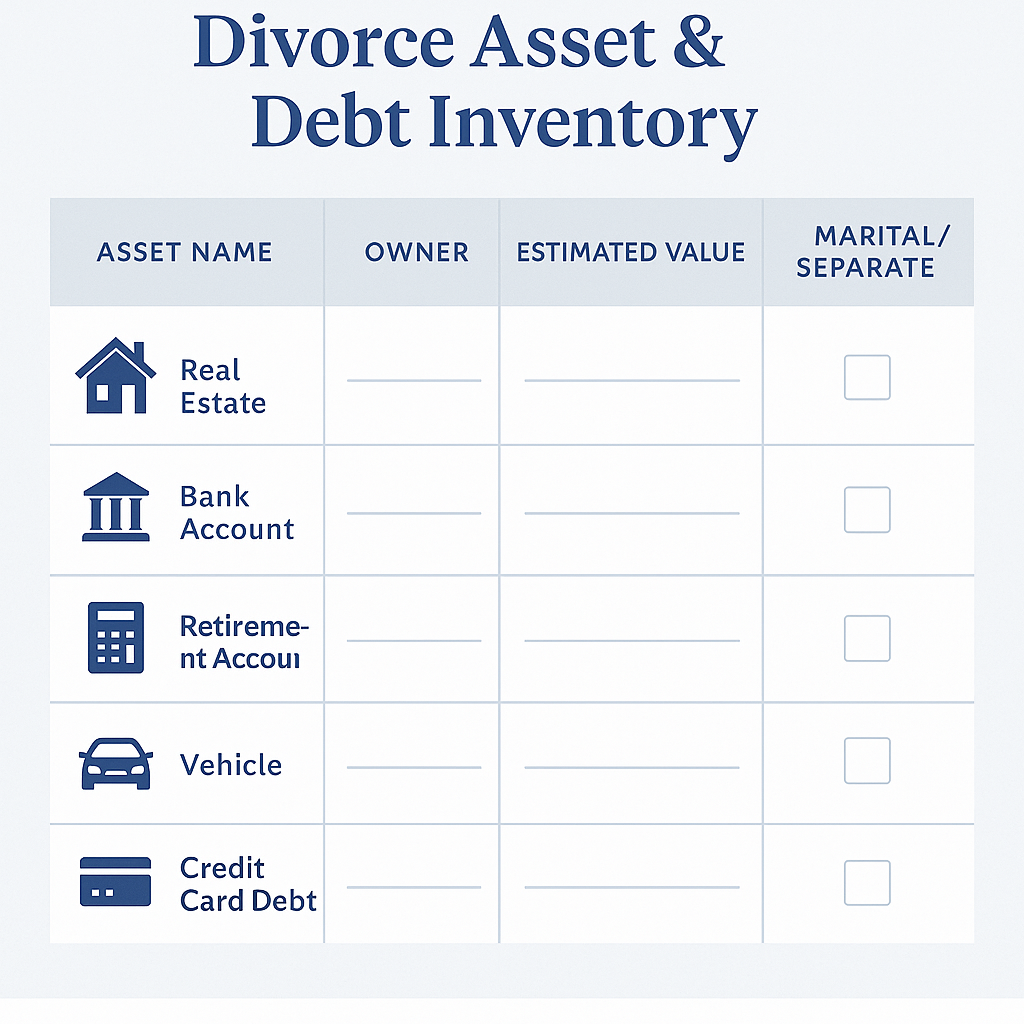

Step 2: Inventory All Assets and Debts

To estimate what you may keep, start by making a comprehensive list of everything you and your spouse own and owe.

Key Categories to List:

- Real estate (residence, vacation property, rental units)

- Bank accounts (checking, savings, joint or individual)

- Retirement and pension plans

- Vehicles, jewelry, and valuable collections

- Credit card balances, loans, and mortgages

- Business interests

📎 Downloadable Tool: “Divorce Asset & Debt Inventory Worksheet”

Divorce_Asset_Debt_Inventory_Worksheet

Step 3: Consider Key Factors That Affect What You Keep

Every divorce is unique. That is why NJ courts look at multiple factors to determine what is fair.

Examples of What Courts Consider:

- Length of the marriage

- Age and health of each spouse

- Each spouse’s income, education, and earning potential

- Standard of living during the marriage

- Whether one spouse stayed home to raise children

- Custody arrangements (especially related to the marital home)

🎓 Expert Insight: According to NJ Statute § 2A:34-23.1, courts must consider 15+ specific factors—none of which automatically outweighs the others.

❗ Red Flag Alert

If your spouse suddenly empties joint accounts, sells marital property without your knowledge, or makes unusual large transfers, contact an attorney immediately. These could be signs of hidden assets or an attempt to unfairly diminish the marital estate.

NJ Asset Division Estimator Understanding Equitable Distribution in New Jersey

Using an Asset Division Calculator (Conceptually)

While you will not find a one-size-fits-all calculator, you can simulate how your property might be split by applying NJ’s principles to your asset inventory.

Case Study Example:

Marital Assets Total: $600,000

- Home equity: $300,000

- Retirement accounts: $200,000

- Savings: $100,000

Separate Assets:

- Spouse A: $50,000 inheritance (kept in separate account)

- Spouse B: None

Spouse A earns significantly more, but Spouse B has primary custody and supported the household for 10 years.

Possible Outcome:

Spouse B may receive a larger share of home equity or retirement funds, based on need and contribution—even if they her/she didn’tdid not earn the income.

Client Success Story

“Ziegler Law Group fought tirelessly to ensure I received a fair share of our business assets. Their expertise made all the difference in my future.”

Why Legal and Professional Help Matters

You can estimate, but only a skilled NJ divorce attorney can evaluate all the legal nuances of your situation.

Situations That Need Professional Valuation:

- A jointly owned business

- Pensions or stock options

- Real estate with fluctuating value

- Hidden or overseas assets

Schedule a consultation with a NJ divorce attorney to assess what you are entitled to

Why Ziegler Law Group Fights for Your Fair Share

At Ziegler Law Group, we understand the emotional and financial stakes behind asset division. Our team has successfully handled hundreds of high net worth and complex property cases across New Jersey.

We Provide:

- Personalized legal strategy

- Access to appraisers and financial analysts

- Strong negotiation and litigation experience

📞 Ready to protect your assets? Call 973-533-1100 or book your consultation today.

❓ New Jersey Divorce FAQs

1. What is “equitable distribution” in New Jersey divorce, and how does it differ from a 50/50 split?

New Jersey follows the principle of equitable distribution. This means that courts aim to divide marital property fairly, taking into account various factors, rather than necessarily equally, recognizing diverse contributions to the marriage.

2. How do New Jersey courts distinguish between “marital property” and “separate property” during a divorce?

Marital property includes assets acquired during the marriage, regardless of who earned them, such as a home purchased together. Separate property consists of assets owned before the marriage or received as inheritances/personal gifts, like an inheritance kept in a separate account.

3. What steps are involved in inventorying assets and debts for divorce in New Jersey?

To estimate what you might keep in a New Jersey divorce, it’s crucial to create a comprehensive list of all assets and debts. Key categories to include are real estate (e.g., residence, vacation property), bank accounts (checking, savings, joint or individual), and retirement/pension plans. Other important categories are vehicles, jewelry, valuable collections, and all outstanding debts.

4. What key factors do New Jersey courts consider when determining a fair division of assets?

New Jersey courts consider numerous factors to ensure an equitable distribution, as every divorce is unique. These factors include the length of the marriage, the age and health of each spouse, their respective income, education, and earning potential, the standard of living enjoyed during the marriage, whether one spouse stayed home to raise children, and custody arrangements (especially as they relate to the marital home). According to NJ Statute § 2A:34-23.1, courts must consider over 15 specific factors, with no single factor automatically outweighs the others.

5. Can an “asset division calculator” accurately predict my divorce outcome in New Jersey?

While there isn’t a single “one-size-fits-all” asset division calculator that can predict your exact outcome, you can conceptually simulate how property might be split by applying New Jersey’s equitable distribution principles to your asset inventory. These conceptual tools help in understanding the factors courts consider. However, due to the complexity and unique nature of each case, no online tool can provide a definitive prediction.

6. Why is legal and professional help crucial for asset division in a New Jersey divorce?

Legal and professional help is essential because only a skilled New Jersey divorce attorney can evaluate all the legal nuances of your specific situation. Certain situations, such as jointly owned businesses, pensions or stock options, real estate with fluctuating value, or hidden/overseas assets, often require professional valuation by appraisers and financial analysts. An attorney can also work with forensic accountants if there’s suspicion of hidden assets, ensuring you receive your fair share.

7. If I have custody of the children, am I guaranteed to keep the marital home?

If a spouse has primary custody of the children, they often have a greater chance of keeping the marital home. This is especially true if retaining the home supports the children’s stability. However, this is not an automatic outcome. You would likely have to buy out your spouse’s interest in the property. The court considers the stability and needs of the children as one of the factors, but the overall financial implications and ability to maintain the home are also important.

8. What happens if my spouse hides assets during the divorce process?

If you suspect your spouse has hidden assets, your attorney can work with forensic accountants to trace and recover the hidden property. This is a critical service as undisclosed assets can significantly impact the fairness of the equitable distribution. Professional legal and financial expertise is vital in uncovering and including all marital assets in the division.