Introduction: Navigating the Complexities of Cryptocurrency in Divorce

In today’s digital age, cryptocurrencies like Bitcoin and Ethereum have become integral components of many individuals’ financial portfolios. As these digital assets gain prominence, they introduce unique challenges in divorce proceedings, particularly concerning asset division.

If you are undergoing a divorce in New Jersey and possess cryptocurrency holdings, it is crucial to understand how these assets are treated under state law. The decentralized and often anonymous nature of cryptocurrencies can complicate equitable distribution, making it imperative to seek legal counsel experienced in digital asset division.

At Ziegler Law Group LLC, we specialize in navigating the intricacies of high-asset divorces involving cryptocurrencies. Our team is adept at ensuring that digital assets are accurately identified, valued, and fairly divided, safeguarding your financial interests throughout the divorce process.

Top NJ Divorce Lawyers for Cryptocurrency Asset Division

Understanding Cryptocurrency as Marital Property in New Jersey

New Jersey adheres to the principle of equitable distribution, which mandates a fair, though not necessarily equal, division of marital assets. Cryptocurrencies acquired during the marriage are typically considered marital property and thus subject to division.

However, the volatile nature of digital currencies and their potential for concealment pose significant challenges. Assets like cryptocurrencies can fluctuate in value dramatically and may be stored in private wallets, making them difficult to trace.

Ziegler Law Group | Cryptocurrency Divorce Guide

Challenges in Dividing Cryptocurrency Assets

1. Valuation Volatility

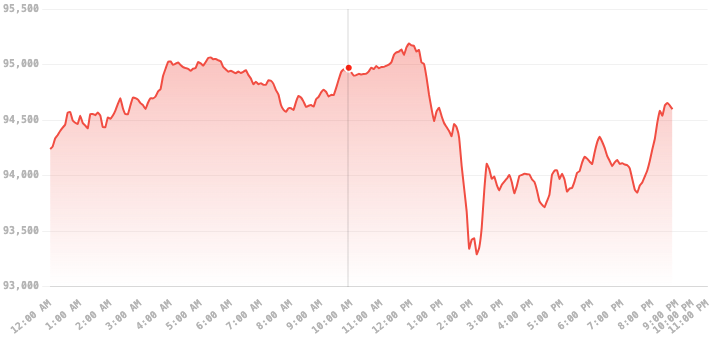

Cryptocurrencies are notorious for their price volatility. For instance, the value of Bitcoin can swing by thousands of dollars in a single day. This volatility complicates the valuation process during divorce proceedings.

A chart illustrating Bitcoin’s price fluctuations over a specific period to demonstrate volatility

In 2024, Bitcoin’s price experienced notable volatility:

-

January 2024: Started at approximately $43,553.16.

-

December 2024: Peaked at around $105,997.90 on December 16, closing the year at $93,897.38.

2. Concealment and Anonymity

The pseudonymous nature of cryptocurrencies allows individuals to conceal assets more easily than traditional financial instruments. A spouse might transfer funds to a private wallet or use privacy coins to obscure transactions.

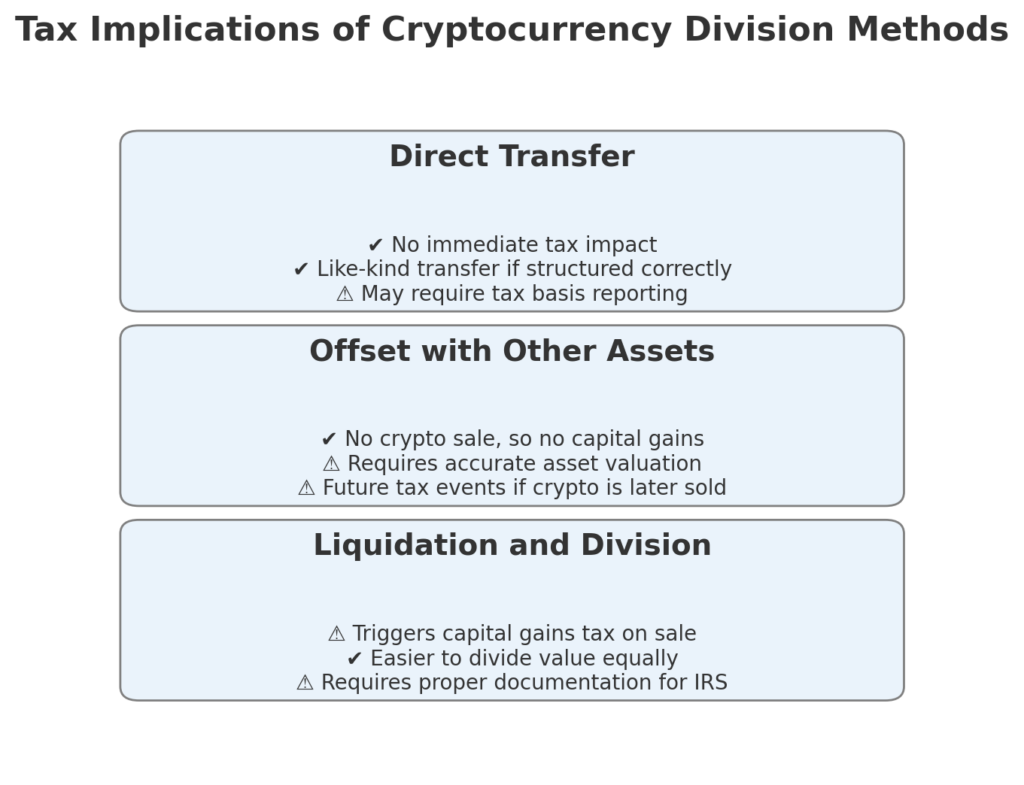

3. Tax Implications

Transferring or liquidating cryptocurrency assets can have significant tax consequences. Capital gains taxes may apply, and failure to account for these can lead to unexpected liabilities.

tax implications of different cryptocurrency division methods

Strategies for Equitable Division of Cryptocurrency

A. Direct Transfer

One approach is the direct transfer of cryptocurrency assets from one spouse to another. This method requires both parties to have digital wallets and a clear understanding of the assets involved.

B. Offset with Other Assets

Alternatively, one spouse may retain the cryptocurrency holdings while the other receives assets of equivalent value, such as real estate or investment accounts.

C. Liquidation and Division

In some cases, liquidating the cryptocurrency and dividing the proceeds may be the most straightforward solution, though this approach must consider potential tax liabilities.

The Role of a Skilled Divorce Attorney

Given the complexities associated with cryptocurrency asset division, enlisting the services of an experienced divorce attorney is paramount. A knowledgeable lawyer can:

- Identify and trace hidden cryptocurrency assets.

- Collaborate with forensic accountants to accurately value digital currencies.

- Navigate the legal and tax implications of asset division.

- Ensure compliance with New Jersey’s equitable distribution laws.

DroomDroom | Blockchain Forensics Explained

Ziegler Law Group | Crypto Divorce Expertise

Conclusion: Protecting Your Digital Assets

As cryptocurrencies continue to permeate financial landscapes, their role in divorce proceedings becomes increasingly significant. Properly addressing the division of these assets requires a nuanced understanding of both the legal framework and the technical aspects of digital currencies.

At Ziegler Law Group LLC, we are committed to providing comprehensive legal support to clients navigating the complexities of cryptocurrency asset division. Our expertise ensures that your digital assets are protected and equitably distributed, aligning with your best interests.

Contact us today to schedule a confidential consultation and take the first step toward securing your financial future.