Introduction: Protecting Your Digital Assets in a New Jersey Divorce

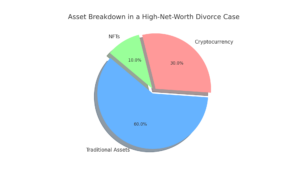

If you are a New Jersey couple going through a divorce, and cryptocurrency is part of your financial portfolio, you are not alone. As Bitcoin, Ethereum, and NFTs become more mainstream, more divorcing couples are facing the question: How do we divide our digital assets fairly?

The truth is, dividing crypto in a divorce is far from simple. It is easy to hide, tough to value, and often overlooked—until it is too late. That is why we created this crypto divorce checklist for NJ couples—a tactical guide designed to help you stay informed, organized, and protected.

At Ziegler Law Group LLC, we have guided numerous high-asset clients through divorces involving digital currencies. This article will walk you through the essential steps to take, common pitfalls to avoid, and how to ensure your digital future remains intact.

—

Why Cryptocurrency Requires a Unique Divorce Strategy

Cryptocurrency does not operate like your average checking account or 401(k). Its decentralized, anonymous nature means it can be harder to trace, more volatile, and trickier to value during a divorce.

Common types of digital assets:

- Cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC)

- Non-Fungible Tokens (NFTs) linked to digital art, music, or media

- DeFi holdings and tokens from platforms like Uniswap or Compound

- Cold storage wallets stored offline

—

Why Cryptocurrency Requires a Unique Divorce Strategy

Crypto Divorce Checklist: 10 Must-Do Steps for NJ Couples

1. Inventory All Crypto Assets

Start by listing every crypto-related holding. Include:

- Exchange accounts (Coinbase, Binance, Kraken)

- Wallet addresses

- DeFi platforms or staking accounts

- NFTs and tokenized real estate

Tip: Even if an account was opened in one spouse’s name, if it was funded during the marriage, it may be considered marital property in NJ.

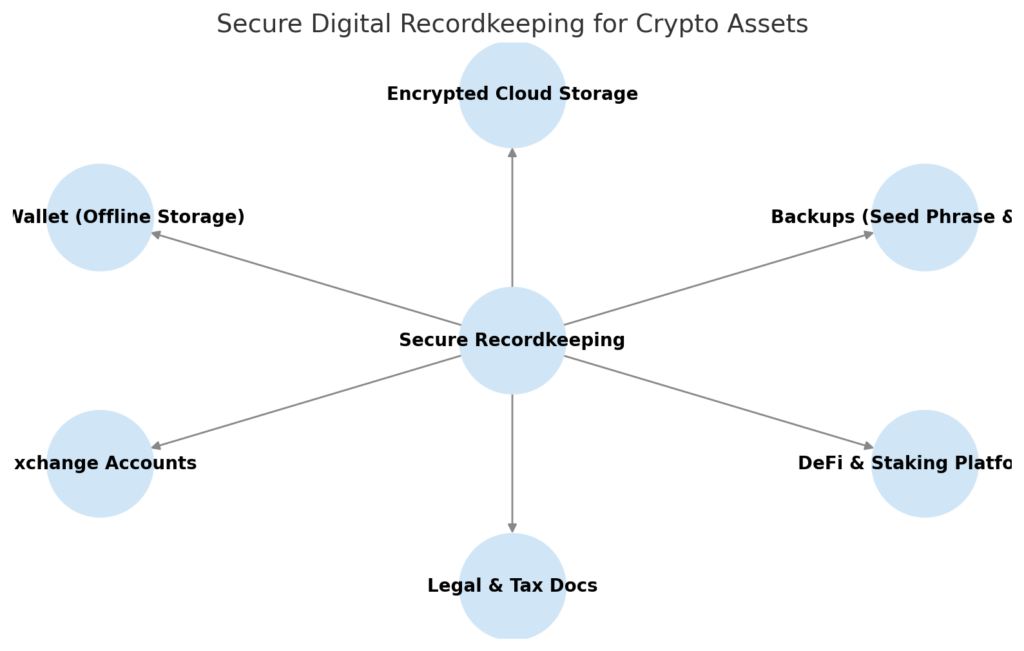

2. Secure Access and Records

Make sure you (and your attorney) have:

- Wallet keys or seed phrases

- Screenshots of current holdings

- Login credentials and transaction histories

- IRS Form 8949 or previous crypto tax filings

Diagram of secure digital recordkeeping for crypto assets.

3. Verify Ownership and Timing

Determine whether the crypto was:

- Purchased before the marriage (potentially separate property)

- Acquired during the marriage (likely marital property)

- Funded with marital accounts or income

4. Determine Marital vs. Separate Property

Under New Jersey’s equitable distribution laws, assets acquired during the marriage are generally divided fairly—not always equally. Assets held before marriage may be exempt, but commingling can change that.

Learn more about equitable distribution in New Jersey divorces.

—

5. Get a Crypto Asset Valuation

Cryptocurrency value changes by the minute. You will need:

- A snapshot of market value as of the separation or filing date

- Help from a financial expert or forensic accountant

6. Understand the Tax Implications

Selling or transferring crypto can trigger capital gains taxes. If you sell $50,000 in Bitcoin, you could owe thousands to the IRS—plan ahead.

7. Consider Your Division Options

You can:

- Transfer crypto directly to your spouse (wallet-to-wallet)

- Offset its value with another asset (e.g., real estate or stocks)

- Liquidate and split the proceeds (be mindful of taxes)

8. Hire a Forensic Accountant if Needed

If you suspect hidden assets, it is crucial to act fast. Crypto transactions can be traced on the blockchain—but it takes a skilled eye to follow the trail.

9. Update Prenups and Postnups

If you are not divorced yet, but digital assets are growing fast, now is the time to amend your marital agreements to account for crypto.

10. Retain a Crypto-Savvy Divorce Lawyer

Most attorneys are not equipped to handle the complexity of digital asset division. Work with someone who understands blockchain, forensic accounting, and NJ family law.

Contact Ziegler Law Group for Crypto Divorce Guidance

—

Real Cases: Crypto Division Done Right

Case 1: $250K in Hidden Bitcoin Recovered

Our client suspected her spouse was hiding digital assets. Through forensic blockchain analysis, we uncovered a wallet with over $250,000 in BTC—ensuring it was added to the marital asset pool.

Case 2: NFT Collection Valued and Split

In another case, a digital artist’s NFT collection was appraised by a third-party expert, with value distributed fairly between spouses through asset offsets.

—

What Makes Ziegler Law Group the Top Choice for Crypto Divorce in NJ

- Decades of high-asset divorce experience

- In-house and partner forensic accountants with blockchain expertise

- Familiarity with NJ courts and equitable distribution statutes

- Discreet, efficient handling of complex digital assets

—

FAQs: Cryptocurrency & NJ Divorce

-

Is crypto considered marital property in New Jersey?

- Yes, if it was acquired during the marriage, it is typically subject to equitable distribution.

-

Can I keep my crypto in a divorce?

- Possibly, depending on the asset’s value and your overall settlement. It may require offsetting with another marital asset.

-

How is crypto tracked if it is anonymous?

- Blockchain is public. With the right tools and forensic experts, hidden wallets can be uncovered.

-

Do I have to sell my crypto to divide it?

- Not necessarily—you can transfer it directly or trade it against other assets.

—

Conclusion: Do Not Let Digital Wealth Disappear in Divorce

Divorce is never easy—but when digital assets are involved, it can become especially overwhelming. With volatile prices, privacy concerns, and tax implications, crypto adds a layer of complexity that most couples are not prepared for.

The good news? With the right team in your corner, you can protect what is yours and walk away from your divorce financially secure.

📞 Call (973) 533-1100

🖥️ Schedule Your Confidential Consultation Today

—

Disclaimer

This article provides general information and is not legal advice. Always consult a licensed attorney for guidance tailored to your unique circumstances.