Dividing assets during a divorce is one of the most critical—and emotional—challenges couples face. In Morris County, New Jersey, equitable distribution laws require fairness, not necessarily a 50/50 split. That means what’s “fair” depends on the specifics of your marriage, finances, and future plans.

Whether you’re protecting a family business, a retirement account, or the home you raised your kids in, understanding how New Jersey handles property division is essential. In this article, we’ll guide you through everything you need to know about dividing assets in a Morris County divorce, with expert legal insight from Ziegler Law Group LLC.

What Is Equitable Distribution in New Jersey?

New Jersey follows an equitable distribution model. This doesn’t mean your property is split evenly—it means the court will divide your marital property fairly based on several factors.

Marital vs. Separate Property

- Marital Property: Assets acquired by either spouse during the marriage (even if only one name is on the title).

- Separate Property: Assets owned before the marriage or acquired by gift or inheritance (as long as they haven’t been mixed with marital funds).

🔗 Learn more about Equitable Distribution in NJ

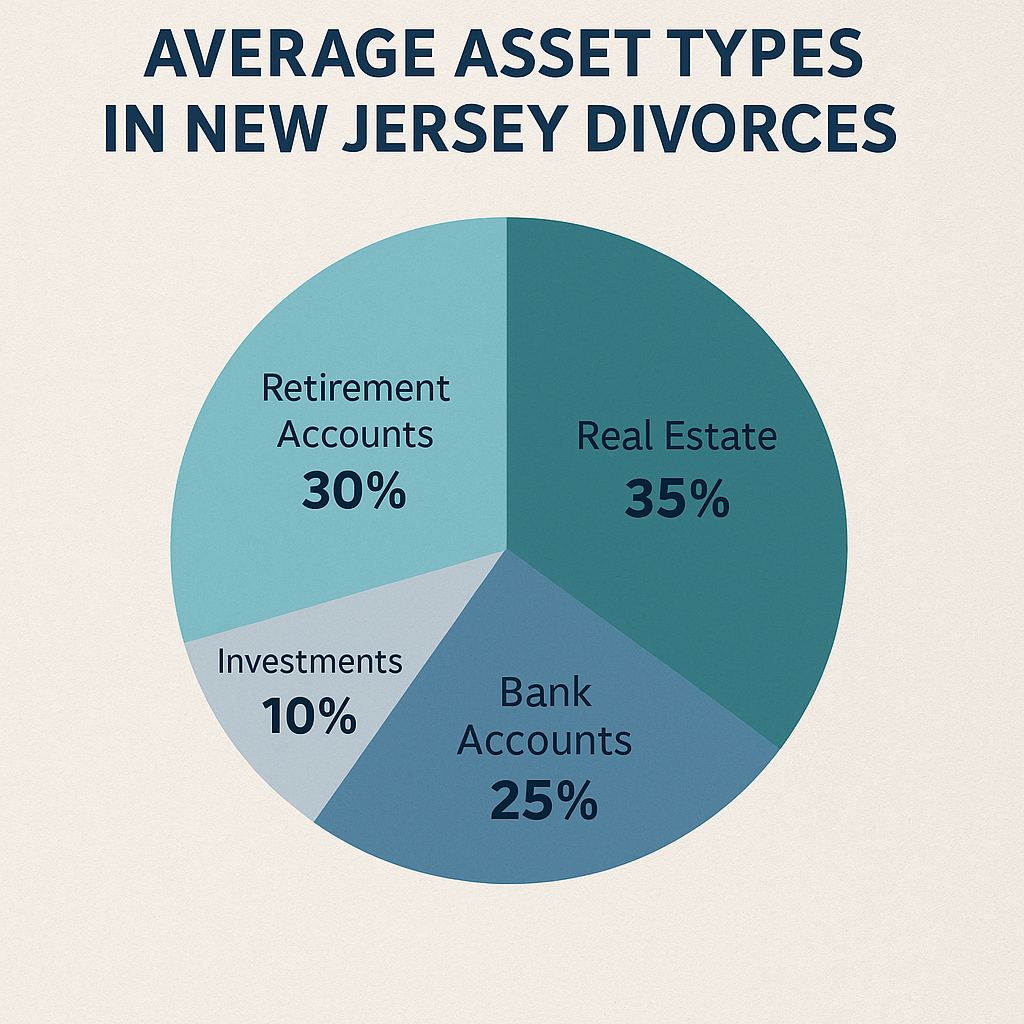

Common Assets Divided in Morris County Divorces

Every divorce is different, but here are some of the most frequently divided assets:

- 🏠 Real estate (homes, vacation property, rentals)

- 💰 Bank and investment accounts

- 🏦 Retirement accounts (401(k), IRA, pensions)

- 🏢 Business interests

- 🚗 Vehicles and valuable personal property

- 💳 Marital debt (credit cards, mortgages, loans)

Average Asset Types in NJ Divorces

How Morris County Courts Determine Asset Division

Morris County family courts consider many factors when deciding what’s “equitable,” including:

- Length of the marriage

- Standard of living during the marriage

- Age, health, and income of each spouse

- Contributions to the marriage (including homemaking)

- Custody of children

- Tax consequences

These factors allow for flexibility—and potential conflict. That’s why legal strategy and preparation are so critical.

Complex Assets That Require Extra Attention

Business Ownership

If you or your spouse owns a business, the court will likely require a professional valuation. Whether the business is sold, divided, or bought out depends on its nature and the level of involvement from each spouse.

🔗 Learn more about High-Asset Divorce in NJ

Retirement Accounts

Dividing retirement funds often requires a Qualified Domestic Relations Order (QDRO) to avoid tax penalties.

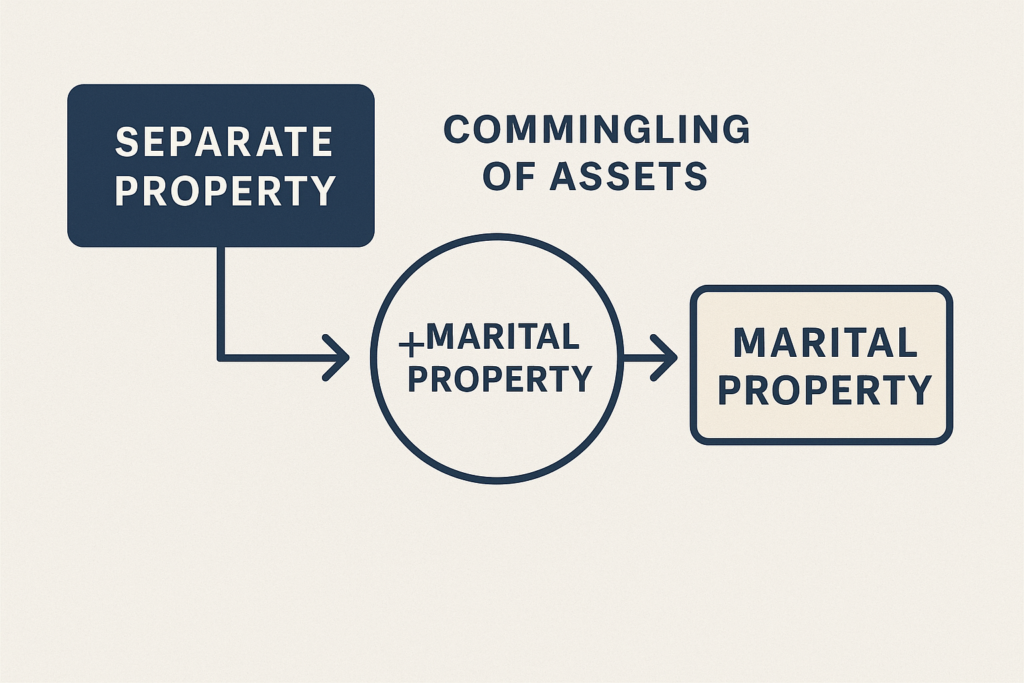

Inheritance and Gifts

Even separate property like inheritances can become marital if they were commingled (e.g., used to buy a family home or deposited into a joint account).

How assets shift from separate to marital property in NJ divorces due to commingling, as shown in this visual guide.

How to Protect Your Assets During Divorce

Here are four key strategies to safeguard your interests:

- Maintain detailed financial records

- Avoid mixing separate and marital assets

- Use legal tools like prenuptial/postnuptial agreements

- Work with an experienced Morris County divorce lawyer

🔐 Early legal planning reduces the chance of unpleasant surprises and ensures your financial rights are preserved.

Real Case Results: How We Helped Our Clients

“Ziegler Law Group found hidden financial accounts my spouse didn’t disclose. Thanks to them, I walked away with what I truly deserved.”

— Client, Morristown, NJ

“My business was my life. Ziegler’s team valued it properly and negotiated a fair buyout so I could keep it.”

— Entrepreneur, Parsippany, NJ

How Ziegler Law Group LLC Can Help

We bring decades of legal experience to complex asset division cases in Morris County. When you work with us, you benefit from:

- ✅ Strategic guidance for high-asset and contested divorces

- ✅ Trusted financial experts and business valuation partners

- ✅ Proven success navigating Morris County courts and judges

- ✅ Personalized service with total discretion

Schedule a consultation to get started with a tailored strategy today.

Summary Table: Key Asset Division Considerations

| Asset Type | Marital or Separate? | What to Watch Out For | Pro Tip |

| Home | Marital (usually) | Who stays? How is equity split? | Get a recent appraisal |

| Retirement | Marital (earned during marriage) | Tax implications, QDRO required | Work with a pension division expert |

| Business | Marital if formed/grown during marriage | Valuation, control issues | Consider a buyout or ownership agreement |

| Inheritance | Separate (if kept separate) | Becomes marital if commingled | Keep funds in individual accounts |

| Debt | Marital (if acquired jointly) | Credit cards, personal loans, mortgages | Include in final settlement agreement |

FAQs About Dividing Assets in NJ Divorce

-

How does NJ decide who gets what in a divorce?

- New Jersey uses equitable distribution, meaning property is divided fairly—not necessarily 50/50.

-

What if my spouse tries to hide assets?

- A forensic accountant or experienced attorney can uncover hidden accounts or income sources.

-

Can I keep my retirement if it’s in my name?

- Not automatically. If earned during the marriage, it’s likely marital property.

-

What happens to the family home?

- Options include selling it and splitting proceeds, one spouse buying the other out, or deferred sale.

-

Do we have to go to court to divide property?

- No. Many couples resolve asset division through mediation or negotiation.

Conclusion: Protect What You’ve Built

Dividing property is one of the most sensitive parts of any divorce. Whether you’re concerned about losing your home, your business, or your retirement savings, don’t leave your future to chance.

The attorneys at Ziegler Law Group LLC are here to ensure fairness, protect your financial interests, and guide you through every step of the process.

📞 Call (973) 533-1100

🖥️ Schedule Your Confidential Consultation Today

Disclaimer

This article is for informational purposes only and does not constitute legal advice. Please consult a licensed New Jersey divorce attorney for personalized guidance.