Picture This: You’re sipping coffee in your Short Hills mansion, the home you built from scratch—every room a testament to your hustle, every corner a memory of your kids’ laughter. Now imagine a divorce tearing it away. Your sanctuary, your equity, your legacy—gone in a courtroom blink.

In a high-asset New Jersey divorce, the family home isn’t just real estate; it’s the prize everyone’s fighting for. The stakes? Millions. The fear? Losing it all. But here’s the secret NJ couples wish they knew sooner: You can take control

With Ziegler Law Group LLC’s expertise, we’ll unravel who gets the family home in a high-asset NJ divorce, what decides it, and how to protect your future—before your ex walks away with your equity.

Understanding High-Asset Divorces in New Jersey

What Makes a Divorce ‘High-Asset’ in NJ?

Let’s cut to the chase: A high-asset divorce in NJ means big money—think net worth over $1 million.

We’re talking Montclair estates, Alpine retreats, or Princeton colonials, where median prices top $650,000—and that’s just the starter homes (NJ MLS, 2024).

For affluent couples, the family home isn’t just a roof—it’s a financial juggernaut and an emotional anchor. Business owners, remarried individuals, or trust fund heirs often tie their wealth to real estate, making it the ultimate battleground in divorce.

Why does it hit so hard? It’s not just the price tag. It’s where you rebuilt after your first marriage, where your kids mastered the backyard swing. Losing it stings—and Ziegler’s here to stop that.

NJ’s Equitable Distribution Law Explained

NJ’s Equitable Distribution Law Explained

Forget 50/50—NJ plays by equitable distribution, where “fair” trumps “equal”.

Under N.J.S.A. 2A:34-23.1, courts divide marital property based on what’s just, not an automatic 50/50 split like California’s community property rules.

Key Factors Courts Consider:

- Marriage length – 10 years or 30?

- Contributions – Your cash, their sweat equity.

- Post-divorce finances – Can you maintain the same lifestyle?

It’s not a coin toss—it’s a chess game. And in high-asset cases, the family home is the king on the board. Don’t guess—let Ziegler guide you.

| Factor | Description | Example |

| Contribution | Who financially contributed or provided care? | One spouse paid the mortgage while the other maintained the household. |

| Marriage Duration | Longer marriages often result in a more even division. | A 25-year marriage sees more equitable distribution than a 3-year marriage. |

| Income & Earning Capacity | Future financial stability and career sacrifices matter. | A stay-at-home parent may receive a larger share due to lost career opportunities. |

| Standard of Living | Courts aim to maintain the lifestyle established during marriage. | If a couple lived in luxury, asset division may reflect that. |

| Custodial Parent Considerations | If children are involved, the custodial parent may retain key assets. | A parent with sole custody may keep the marital home for stability. |

| Separate vs. Marital Property | Assets owned before marriage or inherited are usually separate. | A business started before marriage may not be split, but growth during marriage may be. |

Who Gets the Family Home? Key Factors in NJ High-Asset Divorces

Marital vs. Separate Property: The Ownership Puzzle

The first question: Is the home marital or separate property?

- Bought during marriage with joint funds? → Marital Property—up for grabs.

- Owned pre-vows or inherited? → Separate Property—yours to keep.

Sounds simple, right? Not in high-asset NJ divorces.

Commingling complicates things—like when Sarah, a Ziegler client, used pre-marriage savings to renovate her Mendham marital home. Her ex claimed half, and it took bank records and legal strategy to prove her stake.

Marital vs. Separate Property in NJ Divorces: How is Your Home Classified?

| Question | Answer | Legal Outcome |

| Bought during marriage? | Yes | Marital Property (Split in divorce) |

| Acquired before marriage or as a gift? | Yes | Separate Property (Not divided) |

| Mixed separate & marital funds (renovations, mortgage)? | Yes | May require legal dispute |

| Used inherited funds for home purchase? | Yes | May still be Separate Property (if documented properly) |

Children and Custody: The Stability Factor

- Children tip the scales.

- NJ courts prioritize stability—meaning custodial parents often keep the home to avoid upheaval.

- Example: A Summit mom with twins in a $2M colonial—she gets custody, stays put, and dad negotiates.

- But high-asset divorces flip the script—can the other spouse buy her out with their tech stock windfall? Maybe.

- Temporary stays (e.g., until the kids graduate) happen, too, but permanent ownership is harder to win.

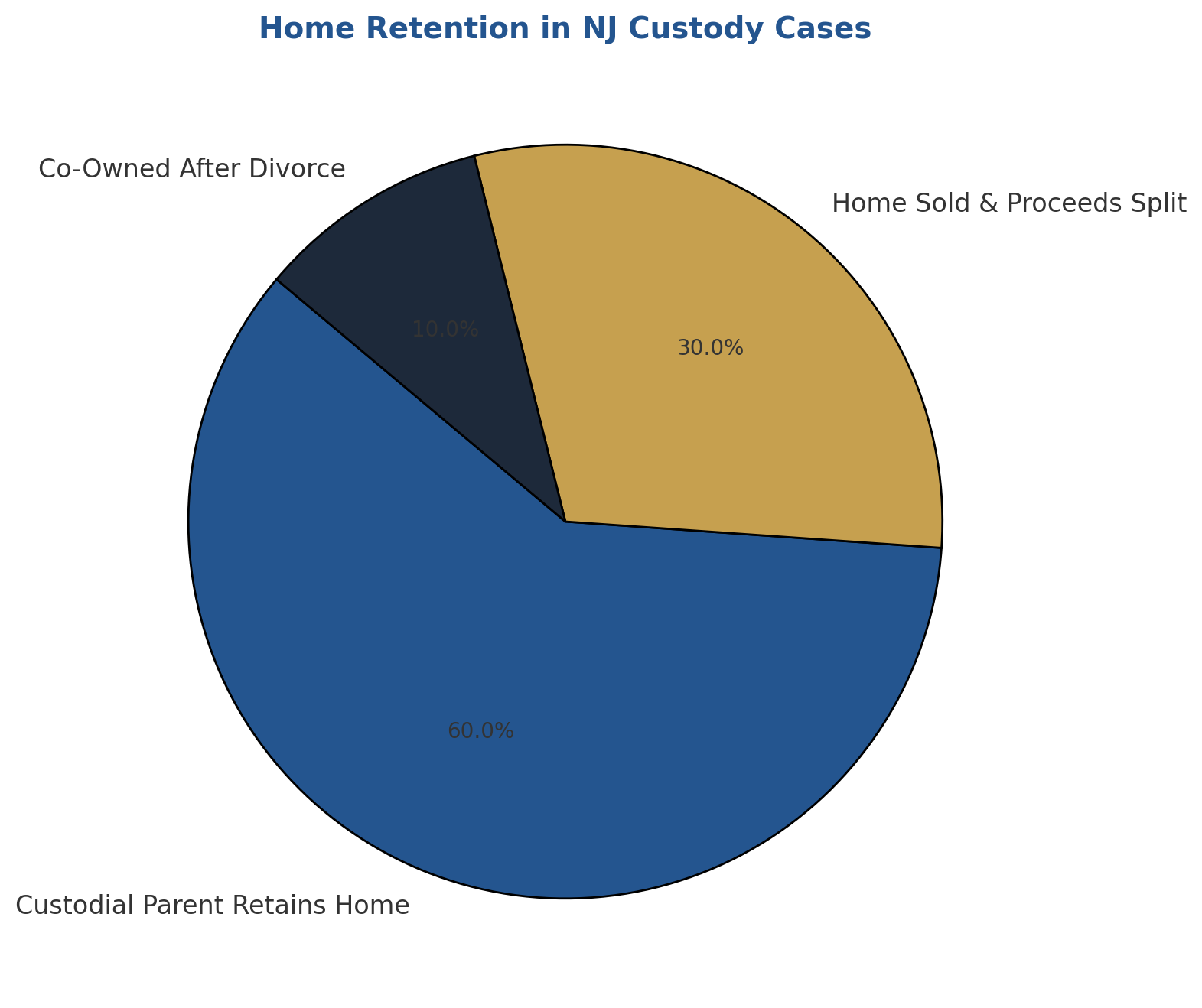

Home Retention in NJ Custody Cases

Financial Contributions and Lifestyle Maintenance

Who fueled the home? Your paycheck or their parenting?

NJ courts consider both—direct financial contributions and indirect support, like raising kids or hosting business events.

Valuation disputes are common—one appraisal says $2.5M, another $3.5M. Ziegler’s team fights for accurate valuations.

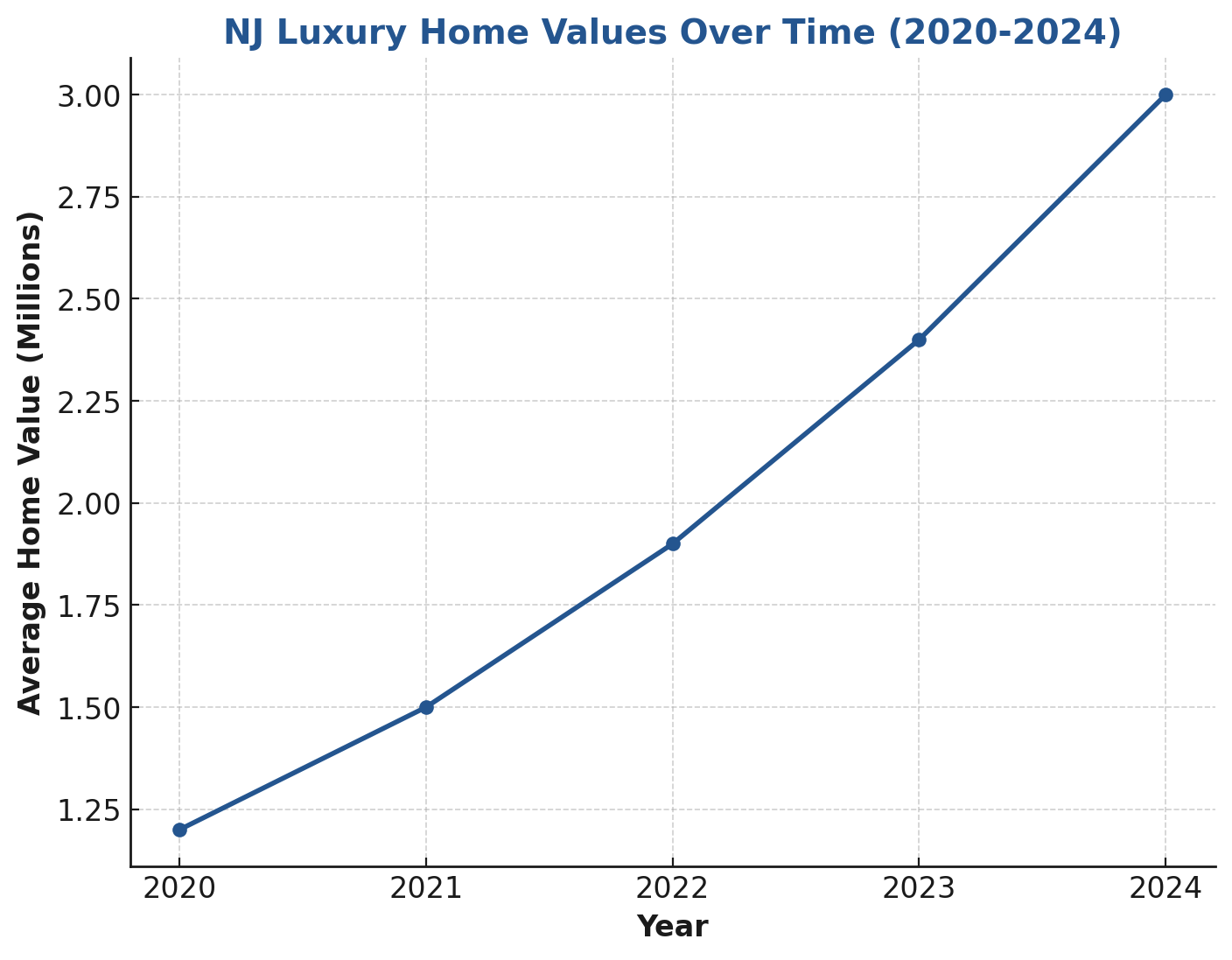

NJ Luxury Home Values Over Time (2020-2024)

(Graph: Zillow)

NJ Luxury Home Values Over Time (2020-2024)

Options for Dividing the Family Home

Buyout: One Spouse Keeps the House

Can’t bear to leave? Buy out your ex’s share—say, $1M for half a $2M home. It’s stability without the chaos, but refinancing at 6-7% (Federal Reserve, 2024) or cashing out investments stings. Pros: You stay, kids thrive. Cons: Your wallet groans. A Ziegler client once refinanced a $3M estate—tough, but she kept her legacy.

Buyout Pros and Cons

| Pros | Cons |

| Stability – You remain in the home, avoiding disruption for children and family life. | High upfront costs – Requires significant cash or refinancing, which can be expensive. |

| Retains investment – You keep the home’s long-term appreciation potential. | Refinancing challenges – Interest rates may be high, increasing mortgage payments. |

| Emotional benefits – No need to move, preserving memories and routines. | Equity trade-offs – You may have to give up other assets in the divorce settlement. |

| Avoids selling costs – No need to pay real estate commissions or deal with market fluctuations. | Financial strain – Ties up cash that could be used for other post-divorce expenses. |

Selling and Splitting Proceeds

No one wins? Sell it. NJ’s 2024 market is sizzling—median prices up 5% (NJ MLS)—so a $2M sale could net $1M each. Taxes bite, though—capital gains on big profits hurt high-asset couples. Emotionally, it’s brutal—waving goodbye to that Chatham dream home cuts deep. But sometimes it’s the cleanest break.

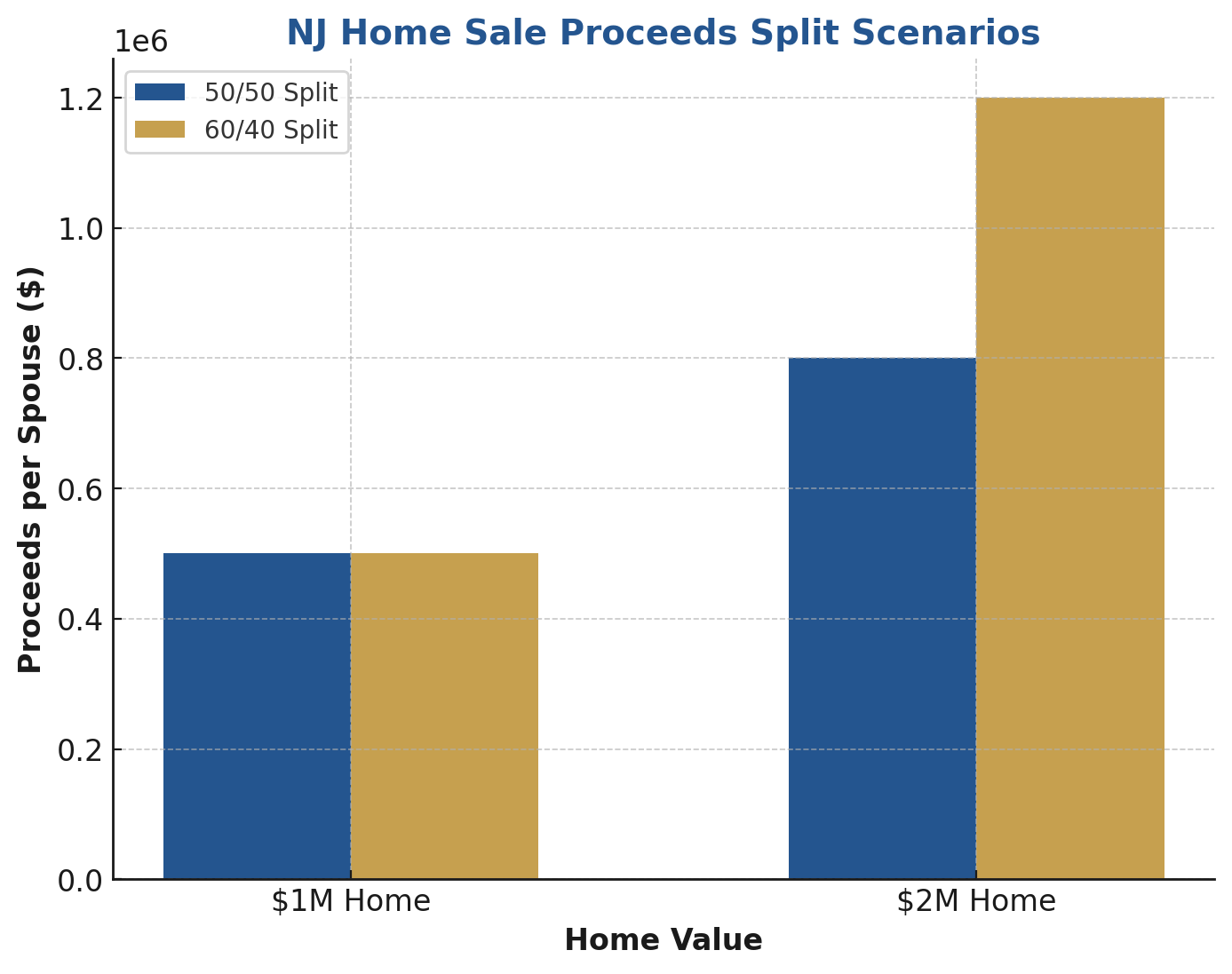

Bar Chart: “NJ Home Sale Proceeds Split Scenarios”

Co-Ownership: A Rare but Possible Path

Wild idea: Share it. Co-own until the kids hit 18, then sell. It’s rare—financial ties post-divorce spark fights—but it works for the amicable. Ziegler helped a Livingston couple co-own a $1.5M home for five years, splitting costs and proceeds later. Not your vibe? Most high-asset folks cut ties faster.

Co-Ownership Timeline Example

Co-Ownership Timeline Example

How to Protect Your Interests in a High-Asset NJ Divorce

Prenups and Postnups: Preemptive Protection

Best hack? Lock it down early. A prenup or postnup can dictate the home’s fate—NJ demands full disclosure, no pressure, and fairness (see our prenup guide). High-asset catch: Vague terms fail when millions hang in balance. Ziegler’s seen prenups cut disputes by 40%—plan right, win big.

Protect Your Home Now—Call 973-533-1100

Working with Experts: Appraisers, Attorneys, and More

Don’t DIY this. A crack appraiser nails the home’s worth—$2M or $3M matters. Ziegler’s NJ divorce attorneys fight for your slice, whether negotiating buyouts or proving separate property. Financial advisors dodge tax traps. “High-asset divorces are marathons,” says a Ziegler pro. “We run them daily—other firms guess, we know.”

Attorneys strategizing at 651 Old W Mt. Pleasant Avenue, Livingston, NJ 07039

Conclusion

Your family home’s fate in a high-asset NJ divorce isn’t luck—it’s strategy. Ownership (marital or separate?), kids, and cash flow decide it. Buy out, sell, or co-own—each path has trade-offs, but inaction risks everything. With remarriage rates climbing (40% of NJ unions, per CDC estimates), high-asset stakes are soaring. Ziegler Law Group LLC protects legacies for NJ’s affluent—business owners, blended families, you. Don’t let your ex cash out your future—call 973-533-1100, grab our free “Home Protection Checklist” at zieglerlawgroupllc.com, or visit us at 651 Old W Mt. Pleasant Avenue Suite 150, Livingston, NJ 07039. Plan today for a stronger tomorrow.