Divorce can be challenging regardless of the circumstances. However, if you are preparing to get divorced when you or your spouse has accumulated substantial assets, the process can be much more complex. High-asset divorces are much more complicated than standard divorces. If you or your spouse has a high net worth, a lot can be at stake.

High-asset divorce cases necessitate having the help of a divorce lawyer in New Jersey at Ziegler Law Group, LLC with significant experience handling complex property division matters. We understand the risks involved in a high net worth divorce and are prepared to work closely with experts, including forensic accountants, tax lawyers, asset valuation experts, investment professionals, and others to protect your legal and financial interests.

Key Takeaways

- High asset divorces involve substantial wealth and complex asset division.

- Requires help of attorneys experienced with complex property cases.

- Issues like hidden assets, support, and property division are challenging.

- Need valuations and documentation for all assets before filing.

- Critical to identify and protect separate property from division.

- Penalties can apply if a spouse hides or wastes assets.

What Is a High Net Worth Divorce?

A high-asset divorce involves a situation in which one or both spouses have substantial wealth and assets and decide to pursue a divorce. Because of the complex nature of the spouse’s holdings and portfolios, the process is much more complicated than a traditional divorce case. A New Jersey high asset divorce lawyer will work closely with a variety of professionals, including appraisers, business valuation experts, forensic accountants, financial advisors, and others to understand the value of your marital estate and ensure you receive a fair portion.

Some of the types of assets that might be involved in a high-net-worth divorce include the following:

- Multiple real properties

- Vacation and rental properties

- Businesses

- Substantial retirement accounts

- Stock options

- Investment accounts, stocks, and bonds

- Trust funds

- Investments held overseas

In many cases, one spouse will have substantially more assets and income than the other spouse. If the higher net-worth spouse has separate assets, protecting them in a divorce is critical to prevent them from being divided.

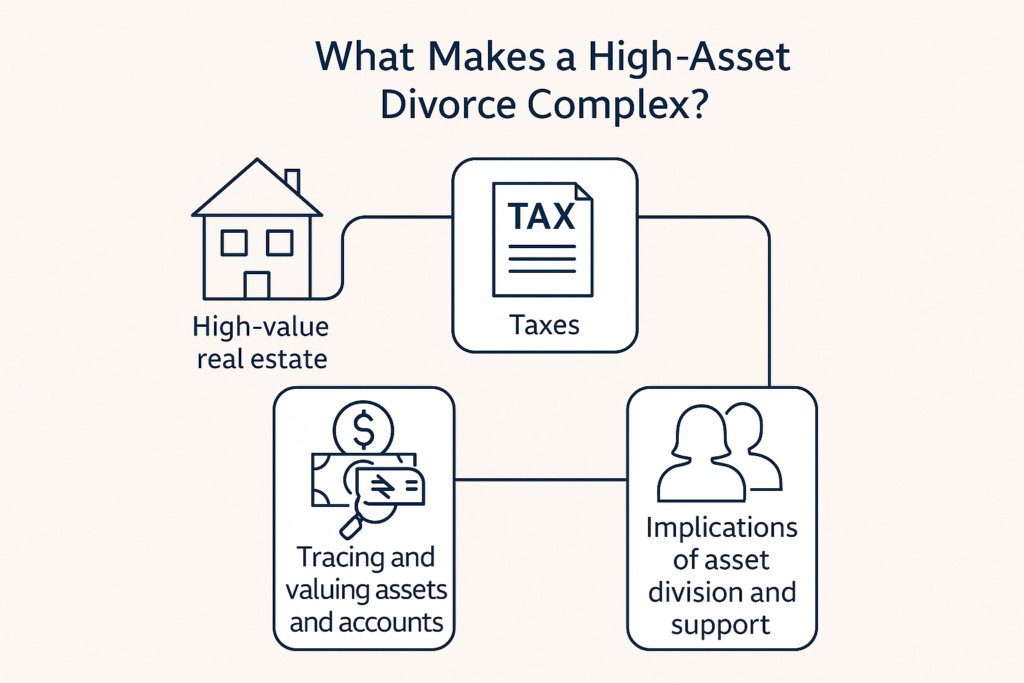

Understanding the multifaceted nature of high-asset divorce: from tax liabilities to hidden assets, this flowchart breaks down the complexity.

Unique Issues in a High-Asset Divorce

High-asset divorces have unique issues that often don’t arise in standard divorce cases. People who have a high net worth have much more to lose if their divorce cases don’t turn out favorably. Because of the significant assets and wealth involved, high-asset divorces typically take much longer to resolve because of the complex issues that can arise.

Hidden Assets

A high-net-worth individual might attempt to conceal assets to prevent them from being divided in divorce by sending assets to a third party, hiding assets in a businesses, setting up shell companies to hold assets, or converting them into cryptocurrency to conceal them. Hiding assets to prevent your spouse from getting what he or she deserves is both unethical and illegal. If you do this, you could face contempt proceedings and, potentially, jail time. If you think that your spouse is hiding assets, you need to work with an attorney and a forensic accountant to track them down.

Significant Spousal Support

If one spouse has been financially dependent on a high-earning spouse throughout the marriage, spousal support will likely be an issue. In many high-asset divorces, one spouse will have earned significantly more money than the other. To allow the lower-earning spouse to maintain a lifestyle similar to what was enjoyed during the marriage, spousal support might be ordered in a significant amount.

If the spouses have been married for 20 or more years, any spousal support that is ordered might have an indeterminate end date and continue until the paying spouse reaches retirement age, the recipient remarries, or the recipient enters into a new cohabiting relationship.

Division of Property

The most hotly contested issue in most high-asset divorces is how to fairly divide the property. This is because high-asset divorces often involve a lot of assets that must be properly valued, inventoried, and divided in a way that minimizes tax consequences.

Determining which assets are the separate property of one spouse and which are marital property is likewise important. Separate assets are those that a spouse owned before the marriage and gifts or inheritances the spouse received during the marriage. However, separate property can become marital property if it has been commingled with marital assets during the marriage.

Dividing High-Value Retirement Accounts

Contributions made by either spouse during their marriage to retirement accounts are marital property and subject to division. Even if a retirement account was opened before the marriage, contributions made to it will be considered marital property and subject to division. Determining which portion of a retirement account is separate property and which is marital can be difficult. Increases and decreases in value during the marriage can complicate the calculation. If a retirement account is divided improperly without a qualified domestic relations order (QRDO), substantial tax liabilities can result.

Dividing Businesses

When one spouse has a business, it can complicate a high-asset divorce. The business will need to be valued, and figuring out how to divide it can be the source of significant conflict. Business valuation experts will likely be necessary, and each spouse will likely have separate business valuations prepared that disagree with each other.

Spoliation or Dissipation of Assets

In some cases, one spouse might spoliate assets out of spite to prevent their spouse from receiving them in the divorce. They might give away expensive items to friends, sell them at a steep discount, or destroy them. In other cases, one spouse might waste marital assets by spending extravagantly, paying for an affair partner’s luxury items, or squandering marital funds in another way in which the other spouse is deprived of those assets.

In these types of situations, the deprived spouse will need to present evidence showing that his or her spouse wasted assets, and the court will decide whether to give the deprived spouse a larger share to make up for the wasted assets. The court might also decide whether to issue penalties to the dissipating spouse for the misconduct if it occurred after the marriage had broken down.

Preparing for a High-Asset Divorce

If you believe your marriage is coming to an end, it’s important to take steps to protect yourself. Start by inventorying all of the assets owned by you and your spouse. Hire professionals to value the assets, and get copies of the most recent account statements for bank accounts, investment accounts, and retirement accounts, life insurance policies, deeds, titles, business tax returns, and individual tax returns. Getting copies of these items and creating an inventory of all of your assets before filing for divorce can help you save thousands of dollars. Copy all financial documents before you file.

Get appraisals and professional valuations of valuable collections, luxury automobiles, yachts, businesses, and real estate holdings. If your spouse has cryptocurrency holdings, find out where they are held.

If you received an inheritance, keep it in a separate account, and never combine the funds with marital funds. Your account should be in your name alone. If you spend some of the money during your marriage, you won’t get that amount back. If you deposit the funds into a joint account, your inheritance will be at risk of being divided in your divorce.

Once you or your spouse file for divorce, don’t try to hide assets. Don’t sell or transfer marital property. When the case is filed, both of you will be prohibited from transferring, giving away, or selling marital assets without the express agreement of the other spouse and the court’s permission. This prohibition will continue until the final divorce decree is issued by the court.

Not all divorce attorneys are the same—compare the skillset of a general divorce lawyer with a high-asset specialist

Speak to an Experienced Attorney for Help With a High Asset Divorce

If you plan to get divorced, and you or your spouse has a high net worth, you need to get legal help from an experienced divorce lawyer as soon as possible. The New Jersey high asset divorce lawyers at Ziegler Law Group, LLC can analyze your case and explain the issues that you might have to contend with. Call us for a confidential consultation at (973) 533-1100.

For the general public: This Blog/Website is made available by the law firm publisher, Ziegler Law Group LLC for information and educational purposes only. It provides general information and a general understanding of the law but does not provide specific legal advice to any reader. By using this site, commenting on posts, or sending inquiries through the site or contact email, you confirm that there is no attorney-client relationship created between you and the Blog/Website publisher. The Blog/Website should not be used as a substitute for competent legal advice you obtain from a licensed attorney in your jurisdiction.

For attorneys: This Blog/Website is informational in nature and is not a substitute for legal research or a consultation/representation on specific matters pertaining to your clients. Due to the dynamic nature of legal doctrines or the current law what might be upheld or viable one day may be changed or modified the next. As such, all of the content of this entire blog must not be relied upon as a basis for arguments to a court or for specific individualized advice to clients without, again, further research or a formal consultation with our professionals.